XRP Price Prediction: Analyzing the Path to Higher Valuation

#XRP

- Technical indicators show bullish MACD momentum with positive histogram reading

- Institutional adoption through Ethena Labs framework and bank integration provides fundamental support

- Bollinger Band positioning suggests potential upward movement toward $3.3573 resistance

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Support

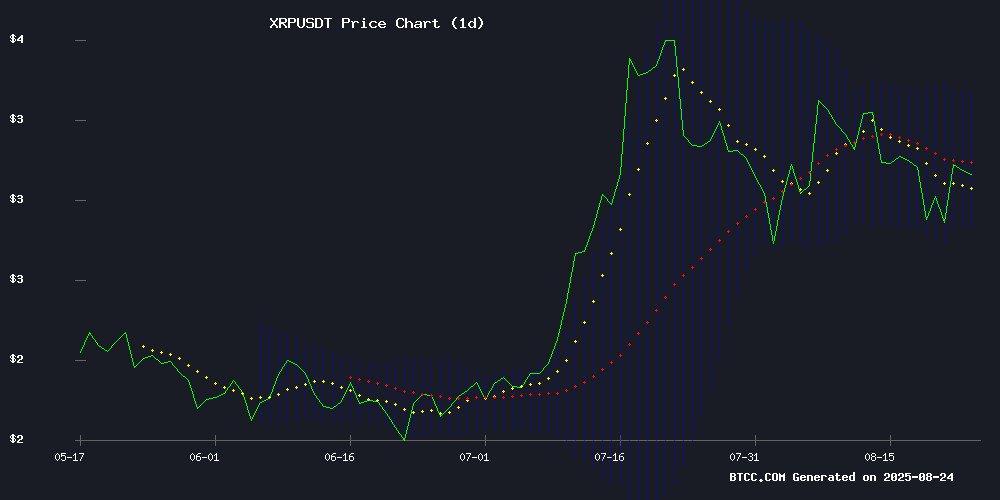

XRP is currently trading at $3.0487, slightly below the 20-day moving average of $3.0945, indicating potential consolidation. The MACD reading of 0.0857 versus 0.0385 signals strengthening bullish momentum as the histogram turns positive at 0.0472. According to BTCC financial analyst Robert, 'XRP remains well-positioned within the Bollinger Bands framework, with the lower band at $2.8317 providing solid support. A break above the middle band at $3.0945 could trigger upward movement toward the upper band resistance at $3.3573.'

Institutional Adoption and Regulatory Progress Fuel XRP Optimism

Recent developments in the Asia Pacific region regarding RWA tokenization and XRP's clearance through Ethena Labs' framework create a fundamentally positive backdrop. BTCC financial analyst Robert notes, 'The integration with USDe stablecoin and growing institutional traction among major banks represents significant validation for XRP's utility. These developments, combined with regulatory shifts favoring tokenization, provide strong fundamental support that aligns with our technical outlook for gradual upward movement.'

Factors Influencing XRP's Price

Asia Pacific Accelerates RWA Tokenization in 2025 Amid Regulatory Shifts

Tokenization is reshaping Asia Pacific's financial infrastructure by unifying issuance, settlement, and custody on a shared digital framework. The technology enhances settlement finality, reduces capital costs, and unlocks 24/7 secondary markets—benefits cascading across issuers, investors, and intermediaries. Cross-border payments and trade finance stand to gain significantly from improved speed and transparency.

Singapore's MAS Project Guardian is spearheading standardization in fixed income, FX, and fund management. Hong Kong leverages its Digital Bond Grant Scheme to attract private deals, while Australia's Project Acacia combines live pilots with proofs of concept. Japan’s FSA is formalizing frameworks for STOs and digital securities.

Regional policy diversity may expand local currency issuance options, including China’s RMB, though USD liquidity remains central. Multi-currency models are enabling novel FX hedging and credit enhancement strategies. Regulatory priorities converge on 'same risk, same rules' enforcement, ledger interoperability, and KYC alignment.

XRP Clears Ethena Labs' Eligible Asset Framework for USDe Stablecoin Integration

XRP has met all criteria under Ethena Labs' newly launched Eligible Asset Framework, positioning it as a top candidate for integration into the collateral backing of the $11.8 billion USDe stablecoin. The asset's $181 billion market capitalization, $10 billion daily trading volume, and deep liquidity satisfied thresholds including $1 billion in open interest and $100 million in spot/futures volume.

Ethena's framework formalizes collateral expansion for USDe, requiring assets to demonstrate robust market depth and activity. XRP now joins BNB and HYPE as prime contenders for onboarding—a move that could further institutionalize the token's role in decentralized finance.

Big Banks Embrace Ripple as XRP Gains Institutional Traction

Ripple has transitioned from a blockchain experiment to a foundational component of global banking infrastructure. Financial institutions now leverage RippleNet for cross-border transactions, processing billions of dollars with unprecedented speed. Q2 2025 saw institutional buyers acquire over $7.1 billion in XRP, signaling deepening adoption among banks and payment providers.

Santander's One Pay FX and SBI Remit exemplify real-world deployment, offering near-instant settlements through Ripple-powered solutions. Regulatory clarity following the SEC settlement has further cemented XRP's position as a compliant institutional asset.

While capital concentrates on established players like XRP, retail investors are diversifying into emerging projects. MAGACOIN FINANCE has emerged as a speculative counterpart—smaller in scale but positioned for exponential growth.

How High Will XRP Price Go?

Based on current technical indicators and fundamental developments, XRP shows potential for measured upward movement. The combination of bullish MACD momentum, strong Bollinger Band support at $2.8317, and positive institutional developments creates a favorable environment. In the near term, resistance levels to watch include the 20-day MA at $3.0945 and the upper Bollinger Band at $3.3573. Breaking these levels could open the path toward higher valuations.

| Key Level | Price (USDT) | Significance |

|---|---|---|

| Current Price | 3.0487 | Consolidation zone |

| 20-day MA | 3.0945 | Immediate resistance |

| Upper Bollinger | 3.3573 | Next major resistance |

| Lower Bollinger | 2.8317 | Strong support level |